Massage guns may be eligible for HSA and FSA reimbursement with a Letter of Medical Necessity (LMN) from a healthcare provider. Check your plan details for confirmation of eligibility for these health savings accounts.

Navigating the realm of Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can often be complex, especially when determining which health and wellness products are covered. A massage gun, a tool increasingly popular for its deep tissue massage capabilities, falls into a category that requires careful consideration.

While not universally accepted as a qualified medical expense, with the proper documentation – specifically a LMN from a licensed healthcare professional – a massage gun could potentially be an expenses covered under your HSA or FSA. This is primarily due to their role in providing therapeutic benefits, such as muscle recovery and pain relief, which ties directly into medical care. Always ensure you are up-to-date with your specific plan’s rules and guidelines to make informed decisions about your eligible wellness expenses.

Credit: www.health-vast.com

The Rise Of Self-care Gadgets

In an era where wellness is a top priority, self-care gadgets have become more than just a trend. Convenient and innovative tools are changing the way individuals approach health and relaxation. Among these, massage guns have soared in popularity, embodying the perfect blend of technology and health benefits.

With the relentless pace of modern life, these gadgets provide a path to personal rejuvenation right at home, saving time and offering flexibility in self-care routines.

Massage Guns: A Popular Wellness Tool

Massage guns are at the forefront of the self-care gadget revolution. Designed to target sore muscles, these handheld devices offer deep tissue therapy to alleviate pain and enhance recovery. Their sudden rise in popularity stems from their ability to replicate professional massage experiences at a fraction of the cost and on your own schedule.

- Portable and easy to use

- Various attachments for targeted relief

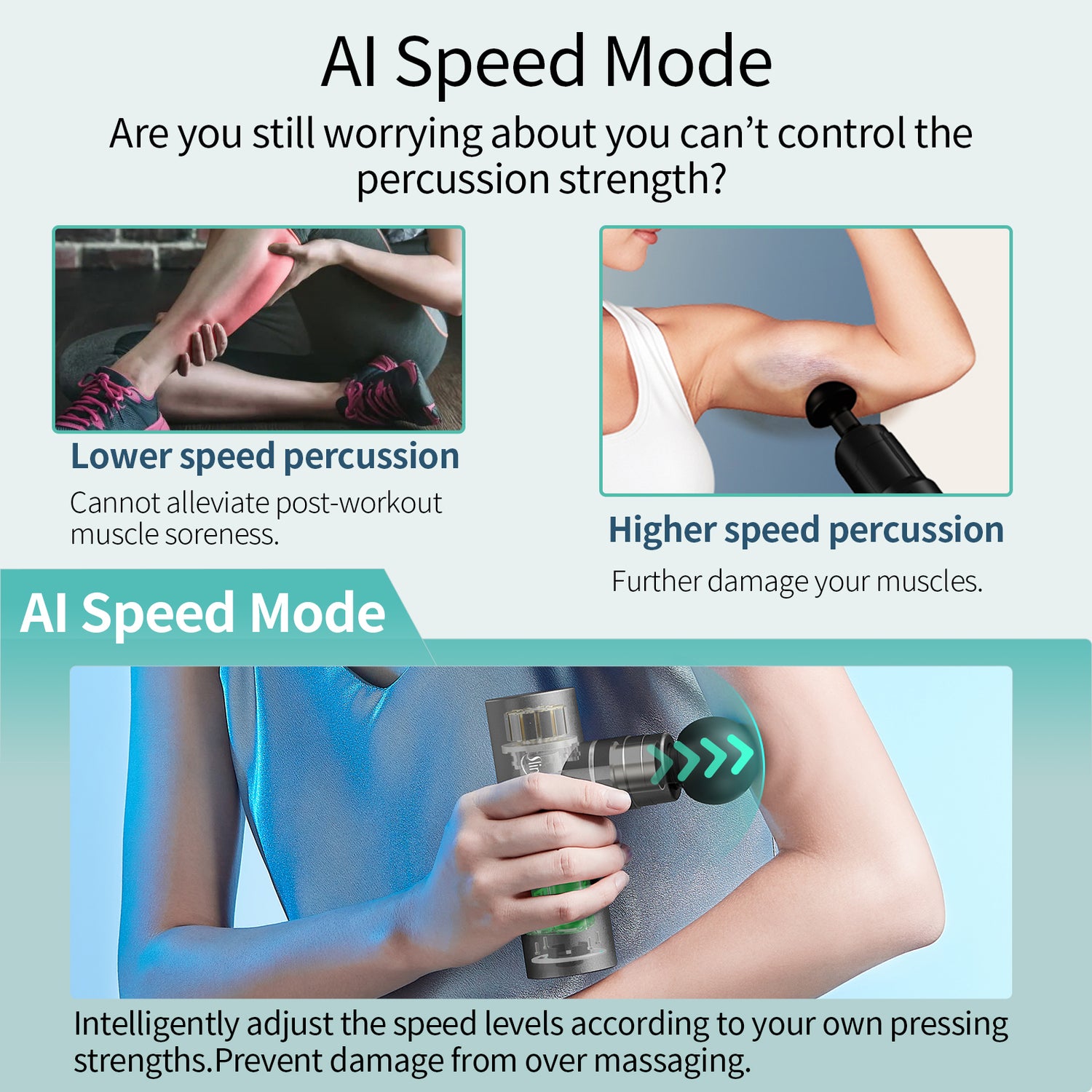

- Adjustable intensity levels

Health Savings And The Tech Connection

With rising awareness about financial planning for wellness, health savings accounts (HSAs) and flexible spending accounts (FSAs) are becoming part of the conversation. Savvy consumers now use these accounts to invest in self-care gadgets like massage guns. FSA/HSA eligibility means massage guns are not only a smart choice for physical health but also for financial well-being.

| Benefits of HSA/FSA Eligible Massage Guns |

|---|

| Tax-advantaged way to purchase |

| Contributes to holistic wellness |

| Smart investment in long-term health |

Understanding Hsa And Fsa Accounts

Taking care of our health often means managing both wellness and finances. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) provide ways to pay for healthcare, including innovative tools like massage guns. Both accounts offer tax advantages, but it’s important to understand their unique features before using them for health-related expenses.

The Basics Of Health Savings Accounts (hsas)

An HSA is a powerful tool for those with high-deductible health plans. You can save money tax-free and use it for medical expenses. Contributions roll over each year, and the account can even earn interest.

- Pre-tax contributions lower your taxable income

- Funds can be invested, potentially growing over time

- Unused funds carry over year to year with no penalty

- Can be used for a variety of medical expenses

Flexible Spending Accounts (fsas) Explained

FSAs offer a different approach. Set aside pre-tax dollars to pay for certain health costs. Money must be used within the plan year with a limited rollover option. An FSA can quickly reduce out-of-pocket expenses for medical care.

- Earmark funds for health costs during open enrollment

- Spend FSA dollars on qualifying expenses within the year

- Employer-based benefit, usually with a “use it or lose it” policy

- May offer a grace period or allow a small rollover to the next year

| HSA | FSA |

|---|---|

| Requires high-deductible plan | Available with most employer plans |

| Funds roll over annually | Limited rollover capability |

| Funds can earn interest | Use funds within plan year |

Both HSAs and FSAs can cover tools like massage guns if deemed medically necessary. Make sure to check with your account provider for eligibility.

Eligibility Criteria For Hsa And Fsa Purchases

Navigating the world of Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA) can be tricky, especially when determining eligible expenses. One intriguing product is the massage gun, a tool gaining popularity for its muscle relief benefits. Let’s explore whether this device meets the eligibility criteria.

Qualifying for Coverage with HSA/FSAQualifying For Coverage With Hsa/fsa

To use HSA or FSA funds on a massage gun, the purchase must be medically necessary. It requires a physician’s prescription stating its use for a specific medical condition, such as muscle pain or recovery therapy.

- Doctor’s prescription – The primary requirement.

- Letter of Medical Necessity (LMN) – Further supports your claim.

Common Misconceptions About Eligible Expenses

Many assume all health-related products are eligible for HSA/FSA coverage. This is not true.

| Myth | Reality |

|---|---|

| All wellness devices are covered. | Only those that are medically necessary. |

| Receipts are not important. | Save all receipts for tax purposes. |

Massage Guns On The Eligible Product List

Discovering massage guns on your health savings account (HSA) or flexible spending account (FSA) eligible product list is like finding a wellness treasure trove. Designed to aid in the relief of sore muscles and improve recovery time, these devices can now potentially be purchased using pre-tax dollars, granting a blend of self-care and savings. Let’s delve into the criteria these massage guns must meet to qualify under your HSA/FSA.

Criteria For Massage Guns Under Hsa/fsa

To ensure a massage gun is eligible under an HSA or FSA, certain criteria must be satisfied:

- Medical necessity: Must aid in the treatment or prevention of a medical condition.

- Documentation: A Letter of Medical Necessity (LMN) from a healthcare provider may be required.

- IRS Guidelines: Must align with the IRS’s definition of a medical expense.

Investigating your plan details is crucial, as eligibility can differ across HSA/FSA providers.

Navigating The Approval Process

The process to confirm if a massage gun is HSA/FSA approved involves a few steps:

- Review your Plan: Check your HSA/FSA guidelines to understand the coverage.

- Obtain an LMN: If necessary, request an LMN from your doctor.

- Keep Receipts: Retain all purchase documents for future reference or claims.

Staying informed and organized will simplify the process of using your HSA/FSA for a massage gun.

Maximizing Your Hsa/fsa For Pain Management

Dealing with sore muscles and body aches can be a daily struggle. To manage this pain, many turn to their Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs). Maximizing your HSA/FSA for pain management not only eases your discomfort but also ensures you’re using your funds wisely.

Strategies For Utilizing Funds Effectively

Smart use of your HSA/FSA can lead to significant savings and better health outcomes. Here are some top strategies:

- Plan ahead for expected expenses.

- Keep track of qualifying items and services.

- Use provider directories to find eligible services.

- Submit claims promptly.

- Stay informed about balance rollovers and deadlines.

Innovative Pain-relief Tools And Reimbursement

Massage guns have become a breakthrough in self-administered pain therapy and are eligible for HSA/FSA reimbursement. Its benefits include:

| Massage Gun Benefit | Description |

|---|---|

| Deep Tissue Relief | Targets deep muscle layers, promoting recovery. |

| Improved Circulation | Enhances blood flow to reduce inflammation. |

| Convenience | Portable for relief anywhere, anytime. |

| Cost-Effective | One-time purchase for ongoing therapy. |

Keep all receipts and proof of payment for easy reimbursement.

Credit: www.walmart.com

Shopping Smart For Hsa/fsa-approved Massage Guns

Massage guns are the latest trend in self-care. But did you know, with a Health Savings Account (HSA) or Flexible Spending Account (FSA), you might get these high-tech muscle relievers without breaking the bank? That’s right! Certain massage guns qualify as medical expenses. This means you can use your HSA or FSA funds to make a purchase. So, let’s dive into how to choose and find these budget-friendly devices.

Top Considerations When Choosing A Massage Gun

- Compatibility: Verify the product is HSA/FSA eligible.

- Effectiveness: Look for devices with proven benefits.

- Quality: Choose guns made with durable materials.

- Warranty: Check for at least a one-year warranty.

- Features: Key features might include multiple speed settings and interchangeable heads.

- Reviews: Read user feedback for real experiences.

- Price: Compare costs while considering long-term value.

Where To Find Hsa/fsa-compatible Devices

You can find HSA/FSA-eligible massage guns at specialty health stores, online HSA/FSA retail websites, or through major online retailers. Some sites have sections dedicated to HSA/FSA products, making your search much easier. Always remember to keep a copy of your receipt for record-keeping purposes.

| Store Type | Pros | Cons |

|---|---|---|

| Specialty Health Stores | Expert advice available | May have higher prices |

| Online HSA/FSA Retailers | Products guaranteed eligible | Limited selection |

| Major Online Retailers | Wide variety, competitive prices | Eligibility not always clear |

Credit: www.amazon.com

Frequently Asked Questions On Hsa Fsa Eligible Massage Gun

Are Massage Guns Fsa Hsa Eligible?

Massage guns may be FSA and HSA eligible with a Letter of Medical Necessity from a healthcare provider. Always check with your plan for specific eligibility requirements.

Can You Use Hsa Or Fsa For Massage?

Using an HSA or FSA for massage therapy is possible with a letter of medical necessity from a healthcare provider. This letter should state that the massage is a medically necessary treatment.

Are Massage Mats Fsa Eligible?

Massage mats may be FSA eligible with a Letter of Medical Necessity from a healthcare provider. Check with your FSA provider for eligibility requirements.

Is A Shiatsu Massager Fsa Eligible?

Yes, a shiatsu massager is typically FSA eligible, provided you have a Letter of Medical Necessity (LMN) from a healthcare provider.

Conclusion

Diving into the features and benefits of HSA/FSA eligible massage guns opens a world of therapeutic possibilities. Remember, relief from muscle pain and stress is now both accessible and affordable. Never before has self-care aligned so perfectly with smart financial planning.

Embrace the comfort these devices offer and make the savvy choice for your health and wallet.